Understanding Singapore’s GST System: A Guide for Businesses

Navigating the intricacies of the Goods and Services Tax (GST) system1Goods and Services Tax (GST) system in Singapore can be a daunting task for businesses, especially those that are newly established. With the right knowledge and tools, however, managing GST compliance2 in Singapore can become a straightforward part of your business operations. This guide aims to provide a comprehensive overview of Singapore’s GST system, offering practical tips to ensure your business stays compliant and maximizes its tax efficiency.

What is GST?

GST, or Goods and Services Tax, is a consumption tax levied on the supply of goods and services in Singapore and on the import of goods into Singapore. As of 2023, the GST rate stands at 8%, set to increase to 9% in January 2024.. It is mandatory for businesses with an annual turnover exceeding S$1 million to register for GST3. However, smaller businesses can also voluntarily register to gain the benefits associated with being GST-registered.

How Does GST Work?

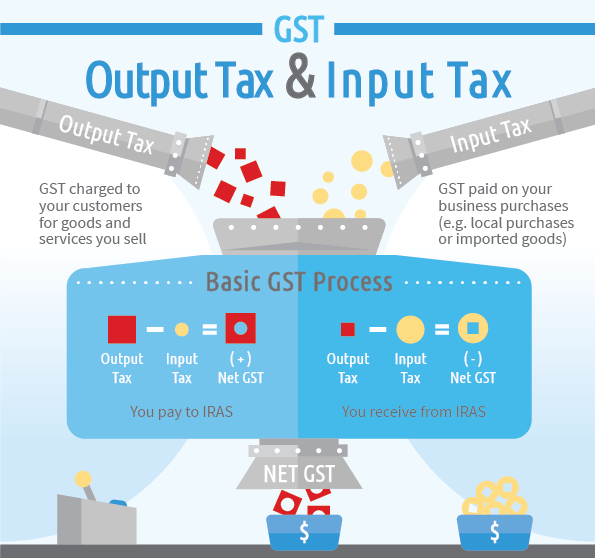

GST is collected by businesses at the point of sale and subsequently paid to the Inland Revenue Authority of Singapore (IRAS)4. The tax collected on sales is called output tax, while the tax paid on business purchases and expenses is called input tax. Businesses can offset the input tax claims5 against their output tax, paying the net difference to IRAS. This mechanism ensures that GST is ultimately borne by the end consumer, while businesses act as collecting agents.

Registering for GST

If your business meets the S$1 million turnover threshold, you must apply for GST registration6 within 30 days from the end of the calendar year. Voluntary registration is also possible and can be advantageous in certain situations, such as improving your business credibility and allowing you to claim input tax credits.

Charging and Collecting GST

Once registered, you need to start charging GST on your taxable supplies. Clearly indicate GST-inclusive prices on your invoices and receipts to ensure transparency with your customers. Additionally, you must issue tax invoices for sales exceeding S$1,000, which should include your GST registration number and other prescribed details.

Claiming Input Tax

To claim input tax, ensure the following:

- The purchases must be used for business purposes.

- The input tax claims must be supported by valid tax invoices or import permits.

- The claims must be made within five years from the end of the relevant accounting period.

Filing GST Returns

GST returns7 are usually filed on a quarterly basis using the GST F5 form. Ensure you submit your returns and make payments by the due date to avoid penalties. The return should detail the output tax collected and input tax claimed, resulting in either a net GST payable or refundable position.

Common GST Errors to Avoid

- 1. Incorrectly charging GST: Ensure you apply the correct GST rate and understand which supplies are zero-rated or exempt.

- 2. Failing to issue proper tax invoices: Maintain proper documentation to support your GST claims.

- 3. Late filing and payment: Submit your returns and make payments on time to avoid late payment penalties and interest.

Benefits of Professional GST Advisory Services

Managing GST compliance can be complex, and errors can lead to costly penalties. Engaging a professional accounting firm can help ensure your business complies with all GST regulations efficiently. Our firm offers comprehensive GST advisory services, from registration and reporting to audits and dispute resolution. We help you navigate the GST landscape, allowing you to focus on growing your business7.

Conclusion

Understanding and managing GST is crucial for businesses operating in Singapore. By following the guidelines outlined in this article, you can ensure your business remains compliant and leverages the benefits of the GST system. For personalized assistance and expert advice, consider partnering with our accounting firm to handle all your GST needs.